Partnership, Resilience, and Innovation

In this time of economic uncertainty, private markets have remained comparatively resilient.

In the first half of 2023, many investors struggled with the “denominator effect” (i.e., a stable private market allocation becoming overweight in a total portfolio as the value of the overall portfolio decreases), curbing appetite for new capital commitments. However, optimism for the remainder of 2023 is evident as alternatives remain an important component of multi-asset portfolios and investors look to hedge against uncertainty.

As a leading capital solutions provider to private market firms, we seek to create innovative structures that meet the individual needs of our underlying partner managers, while continuing to deliver strong and consistent returns to our investors. As discussed in more detail below, we believe that the current environment provides attractive opportunities to provide attractive, risk-mitigated returns through acquiring stakes in large, diversified, institutionalized managers.

GP Stakes is broadly defined as non-controlling minority investments in private capital managers. Below are a few key themes we believe are driving the private capital industry and specifically the GP Stakes market for 2023.

Ample catalysts exist for future GP Stakes deals

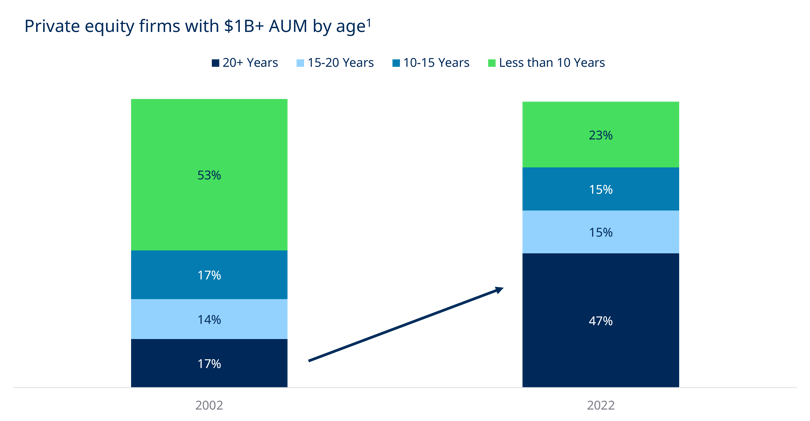

Following several decades of consistent growth, the private capital industry is maturing, leading to further consolidation in the space. According to Preqin, from 2012 to 2022 the proportion of private equity firms over 20 years old increased from 29% to 47%.

Emerging managers are disadvantaged in the current fundraising environment and often need to finance their operations without strong balance sheets. GP Stakes transactions have grown over the past two years. Many of these transactions involve seasoned managers, where the track record and longevity of the strategy being acquired are considered major intangible assets.

Investors remain committed to private markets despite fundraising headwinds and macroeconomic concerns

According to recent Preqin findings, more than three-quarters (81%) of investors surveyed think we are currently on a decline or approaching the bottom of both the macroeconomic and real estate market cycles. Respondents believe that the equity market is further ahead – 26% think it is already starting to recover. Investors are also increasingly mindful of the growing valuation gap between public and private equity. Overall, both structural and market-related factors are creating a challenging fundraising environment.

The share sell-off in public equities and fixed income securities in 2022 left many investors grappling with the denominator effect and a reduced appetite for new capital commitments. Recent data indicates that investors remain willing to deploy fresh capital. More than half of all investors surveyed by Preqin are targeting fund commitments in the third quarter of this year, and an additional 8% are expecting to make commitments before year-end.

Established GPs are well-positioned as more capital is contributed to larger, more seasoned managers

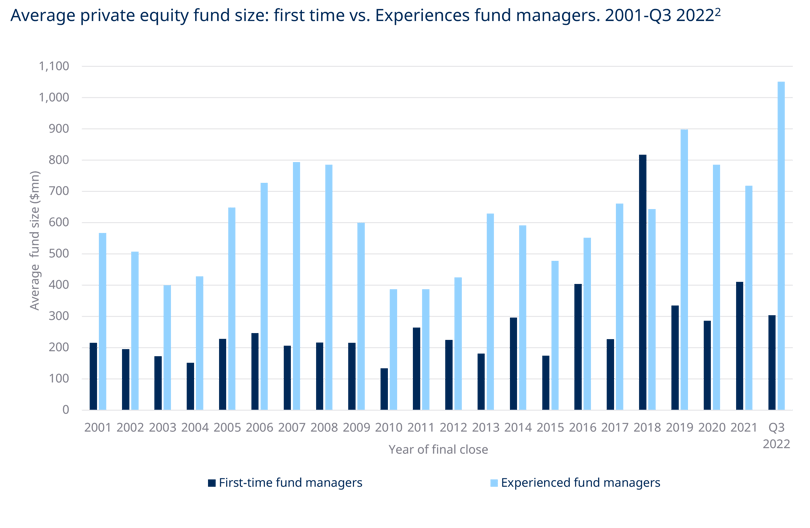

Fundraising is becoming more challenging for new GPs as a greater share of total fundraising is now likely to take the form of re-ups to existing manager relationships.

The combination of weaker LP appetites and a more competitive fundraising market seems to favor established fund managers. Preqin data shows that average fund size for experienced fund managers this year has increased by 46.3% to $1.1 billion, while fund size for first-time fund managers shrank by 25.8% to $300 million.

Overall, the top ten funds in 2022 made up ~34.1% of capital raised in 2022, compared with 21.2% in 2021. Fewer new managers have joined the market than in any other year, allowing experienced fund managers to maintain the upper hand.

Private market performance remains strong

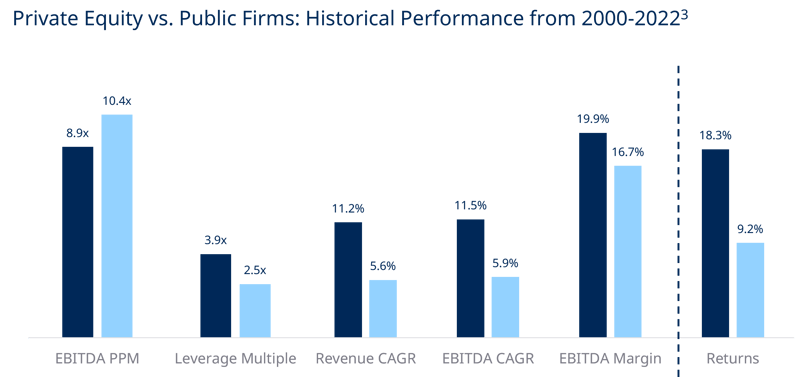

Private market performance has generally remained more resilient than public markets, continuing a trend that has been apparent over the past two decades. According to Pitch Book, in 2022 PE returns experienced only a mild correction, while the S&P 500 ended the year down 19.4%. We believe this outperformance is largely driven by the long-term focus of private equity firms, who are able to work closely with the management teams to support growth. As shown below, private equity-backed companies have exhibited superior operating performance to public companies over the last two decades.

In conclusion...

We believe that underlying market dynamics will continue to favor large, institutionalized GPs in the current fundraising and deal environment. Catalysts for GP stakes deals are robust, as GPs look to diversify their offerings and fortify their balance sheets. We believe that we are well-positioned to capitalize on this opportunity as the largest investor in the space, having raised over 60% of capital raised by the 10 largest GP Stakes Funds4, to pursue this strategy globally and having closed over 85% of transactions larger than $600 million5.

Sean Ward

Senior Managing Director, Blue Owl Capital

Past performance is not a guarantee of future results. The views and opinions expressed herein are those of Blue Owl and are subject to change as markets and other conditions fluctuate. Blue Owl is under no obligation to update or keep current the information presented.

Please see endnotes and important information at the end of this page.