Leveraging deep and extensive relationships across the alternative asset management ecosystem, Blue Owl seeks to deliver sustainable cash flow returns and diversified exposure to private markets growth.

Frequently asked questions about our investment strategy

A transaction where an investor acquires a minority interest in an alternative asset manager (the General Partner, or GP). Minority investments are typically structured as an equity investment, a preferred or otherwise structured equity investment, or a revenue share.

Our counterparties are primarily institutional private capital managers in all areas, including:

They may have several potential financial motivating factors, including:

GP commitment

New products

Platform expansion

Succession planning

Cap structure reorganization

A GP stake investment may be “primary,” where the investor buys new interests in the firm, existing owners are diluted and the invested cash goes onto the firm’s balance sheet, or “secondary,” where existing equity holders sell their interests to the investor. Although terms vary, transactions typically involve the purchase price being paid over multiple years. A minority owner’s interest is usually permanent and entitles the holder to a share of the GP’s cashflow, which is generated by the fees and carried interest charged on the GP’s funds as well as returns made from investments on the GP’s balance sheet (i.e., the GP’s co-investments in its own funds).

A GP stakes investment typically invests in a holding company shoulder-to-shoulder with a firm’s senior partners, potentially providing returns from at least three sources:

A transaction where an investor acquires a minority interest in an alternative asset manager (the General Partner, or GP). Minority investments are typically structured as an equity investment, a preferred or otherwise structured equity investment, or a revenue share.

Our counterparties are primarily institutional private capital managers in all areas, including:

They may have several potential financial motivating factors, including:

GP commitment

New products

Platform expansion

Succession planning

Cap structure reorganization

A GP stake investment may be “primary,” where the investor buys new interests in the firm, existing owners are diluted and the invested cash goes onto the firm’s balance sheet, or “secondary,” where existing equity holders sell their interests to the investor. Although terms vary, transactions typically involve the purchase price being paid over multiple years. A minority owner’s interest is usually permanent and entitles the holder to a share of the GP’s cashflow, which is generated by the fees and carried interest charged on the GP’s funds as well as returns made from investments on the GP’s balance sheet (i.e., the GP’s co-investments in its own funds).

A GP stakes investment typically invests in a holding company shoulder-to-shoulder with a firm’s senior partners, potentially providing returns from at least three sources:

Our 90+ person team3 is a market leader in providing capital solutions to leading private markets managers.

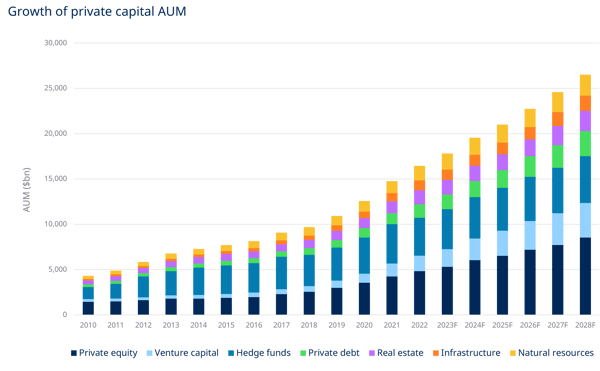

For GPs looking to diversify their offerings, fortify their balance sheets and capture the growing demand for exposure to the private markets, we believe the potential opportunity set will likely continue to grow.

Key drivers of growth in private markets include7:

Private markets strategies have generally demonstrated strong performance vs. public markets

A broad-based under-allocation to private markets from both institutional and retail investors

Companies staying private for longer

Lower barriers for retail participation in the private markets

An investment in GP Stakes offers limited partners several potential benefits.

Investors typically benefit from three cashflow streams, including contractually locked-in management fees.

Owning at the GP level can provide meaningful potential vintage year, geographic, sector, asset class and enterprise value diversification.

Paid cross-cycle, potentially generating material cash flow during an economic downturn when other assets are not generating yield, are being written down, or both.

GP Stakes offers exposure to private markets as an asset class, which is growing tremendously and forecasted to reach $21.6 trillion AUM by 2028.8

Get in touch with a member of our Private Wealth sales team today.

Individual investors, please contact your financial advisor for more information.

Endnotes

Important information

Unless otherwise noted the Report Date referenced herein is as of November 30, 2025.

Past performance is not a guarantee of future results.

Assets Under Management (“AUM”) refers to the assets that we manage and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Credit and Real Assets products; and (v) par value of collateral for collateralized loan obligations (“CLOs”) and other securitizations.

The webpage presented is proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, funds sponsored by Blue Owl, including the Blue Owl Credit, GP Strategic Capital Funds and the Real Assets Funds (collectively the “Blue Owl Funds”) as well as investment held by the Blue Owl Funds.

An investment in the Fund or other investment vehicle entails a high degree of risk. Prospective investors should consider all of the risk factors set forth in the "Certain Risk Factors and Actual and Potential Conflicts of Interest" of the PPM or Prospectus, each of which could have an adverse effect on the Fund or other investment vehicle and on the value of Interests.

An investment in the Fund or other investment vehicle is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity associated with an investment in the Fund or other investment vehicle. Investors in the Fund or other investment vehicle must be prepared to bear such risks for an indefinite period of time. There will be restrictions on transferring interests in the Fund or other investment vehicle, and the investment performance of the Fund or other investment vehicle may be volatile. Investors must be prepared to hold their interests in the Fund or other investment vehicle until its dissolution and should have the financial ability and willingness to accept the risk characteristics of the Fund's or other investment vehicle’s investments.

There can be no assurances or guarantees that the Fund's or other investment vehicles investment objectives will be realized that the Fund's or other investment vehicle investment strategy will prove successful or that investors will not lose all or a portion of their investment in the Fund.

Furthermore, investors should not construe the performance of any predecessor funds or other investment vehicle as providing any assurances or predictive value regarding future performance of the Fund.

The views expressed and, except as otherwise indicated, the information provided are as of the report date and are subject to change, update, revision, verification, and amendment, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this webpage may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties (including those discussed below) that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl’s or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this webpage.

This webpage contains information from third party sources which Blue Owl has not verified. No representation or warranty, express or implied, is given by or on behalf of the Blue Owl Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this webpage and no liability whatsoever (in negligence or otherwise) is accepted by the Blue Owl Entities for any loss howsoever arising, directly or indirectly, from any use of this webpage or its contents, or otherwise arising in connection therewith.

All investments are subject to risk, including the loss of the principal amount invested. These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment advisor and the dealer manager, potential illiquidity, and liquidation at more or less than the original amount invested. Diversification will not guarantee profitability or protection against loss. Performance may be volatile, and the NAV may fluctuate.

This webpage is for informational purposes only and is not an offer or a solicitation to sell or subscribe for any fund or other investment vehicle and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, of any fund or investment vehicle managed by Blue Owl, or of any other issuer of securities. Only a definitive offering document (i.e.: Prospectus or Private Placement Memorandum or other offering material) can make such an offer. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus, Private Placement Memorandum or other offering material is truthful or complete. Any representation to the contrary is a criminal offense. Securities are offered through Blue Owl. Within the United States and Canada, securities are offered through Blue Owl Securities LLC, member of FINRA/SIPC, as Dealer Manager.