The evolving investment landscape.

Private markets continue to surge, with assets under management (AUM) projected to surpass $24 trillion by 20271 more than doubling from $10 trillion in 20212. As this asset class becomes more mainstream, investors are exploring a broader range of vehicles to participate in its growth.

While traditional drawdown fund structures remain a strong fit for many investors, particularly those comfortable with longer time horizons and capital lockups, others—especially those newer to private markets or seeking greater liquidity—are increasingly looking for alternative access points.

One structure gaining significant traction is the evergreen fund.

With features that may include immediate capital deployment, reinvestment of proceeds, and periodic redemption windows, evergreen funds offer a more flexible approach to private market investing. These characteristics can help reduce common barriers to entry—such as long ramp-up periods and limited liquidity—but aim to maintain the core benefits of alternative investments.

To help you evaluate how evergreen funds compare to traditional drawdown funds, we’ve outlined their key differences in this resource.

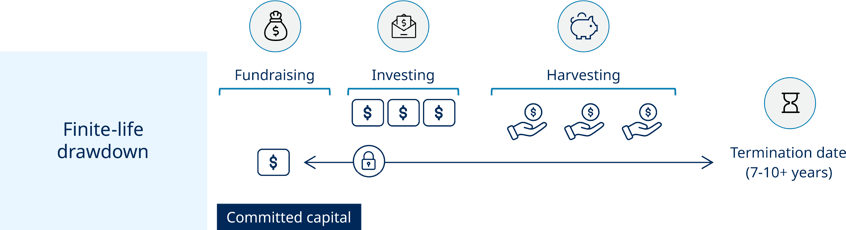

A drawdown fund, also known as closed-end or finite-life fund, is the standard investment vehicle used in private equity and venture capital.

Unlike typical public-market funds, drawdown vehicles don’t immediately invest all funds. Instead, investors commit a specified amount of capital upfront.

Then, throughout the fund’s initial investment period, the fund manager issues “capital calls” to investors, gradually deploying their commitments into targeted investments.

In the interim, undeployed capital is typically held—at the investor’s discretion—in a mix of cash, cash equivalents, bonds, and public equities, depending on individual preferences and portfolio strategy.

Drawdown funds generally have a defined lifecycle (e.g., ten years) with potential extensions to facilitate exits and fully realize returns3. This structure is common in private equity, venture capital, and other alternative strategies for patient, long-term capital.

For illustrative purposes only. Actual fund features, including subscription, redemption, and reinvestment policies, may vary and are subject to fund-specific offering documents and market conditions. There is no guarantee of immediate capital deployment, reinvestment of proceeds, or availability of liquidity windows.

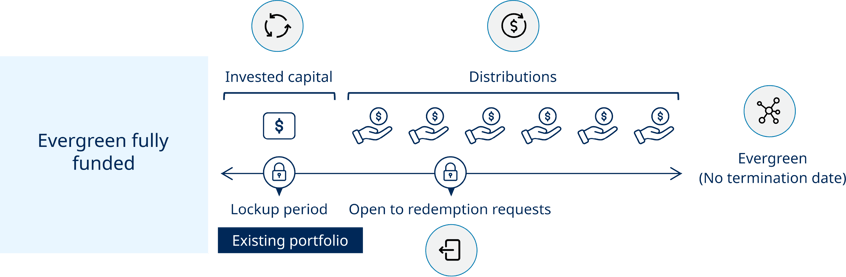

An evergreen fund, also known as an open-ended or perpetual fund, is a private market investment vehicle designed for continuous capital raising and long-term portfolio exposure.

Unlike drawdown funds, evergreen vehicles do not have a fixed end date. Instead, they typically allow investors to subscribe at regular intervals, subject to limitations. Capital is often deployed immediately into a diversified portfolio of private assets.

While distributions of income may be delivered throughout, as investments generate returns or are exited, proceeds are typically reinvested rather than distributed—helping maintain consistent exposure and support compounding potential.

These funds typically offer periodic redemption windows—often quarterly—subject to liquidity constraints (e.g., up to 5% of net assets).

Evergreen funds are increasingly used across private equity, credit, and real asset strategies, offering a streamlined way to access private markets with reduced operational complexity and improved liquidity features.

For illustrative purposes only. Actual fund features, including subscription, redemption, and reinvestment policies, may vary and are subject to fund-specific offering documents and market conditions. There is no guarantee of immediate capital deployment, reinvestment of proceeds, or availability of liquidity windows.

| Category | Drawdown fund | Evergreen fund |

|---|---|---|

| Cell label Capital commitment & deployment | Cell label Investors commit capital upfront; deployed gradually via capital calls over time | Cell label Immediate deployment upon investment; capital is continuously raised and reinvested |

| Cell label Fund lifecycle & structure | Cell label Fixed term (typically ~10 years); structured entry and exit periods | Cell label Indefinite, open-ended structure with no set end date |

| Cell label Liquidity & redemption | Cell label Illiquid until investments are exited or mature; liquidity events planned | Cell label Periodic redemption windows (e.g., quarterly); up to 5% of NAV may be redeemed, subject to terms |

| Cell label Investment proceeds | Cell label Realized proceeds are distributed to investors | Cell label Proceeds are reinvested into new opportunities, maintaining portfolio exposure |

| Cell label Transparency & reporting | Cell label Less frequent NAV updates; valuations may be opaque between reporting periods | Cell label Frequent NAV reporting (monthly or quarterly); enhanced transparency due to SEC oversight |

| Cell label Tax documentation | Cell label Investors receive Schedule K-1 | Cell label Investors typically receive Form 1099 |

| Cell label Exit strategy | Cell label Defined exit strategy (e.g., IPO, sale, recapitalization) aligned with fund term | Cell label No predefined exit; investors can enter/exit more flexibly over time |

| Cell label Investor appeal | Cell label Suited for long-term, illiquid commitments with structured timelines | Cell label Appeals to investors seeking flexible, streamlined access to private markets |

For illustrative purposes only. Actual fund features, including subscription, redemption, and reinvestment policies, may vary and are subject to fund-specific offering documents and market conditions. There is no guarantee of immediate capital deployment, reinvestment of proceeds, or availability of liquidity windows.

While traditional drawdown funds are designed to target strong absolute returns, their staged capital deployment can lead to periods of idle capital—commonly referred to as “cash drag.” In contrast, evergreen funds deploy capital immediately and continuously, which can help accelerate compounding and improve overall return efficiency.

Rather than viewing these structures as either/or, many advisors are now combining them. Evergreen funds can serve as a core allocation, offering the potential for steady exposure, reinvestment of distributions, and liquidity flexibility. Meanwhile, drawdown funds can act as satellite positions, providing targeted access to specific managers, strategies, or vintages.

Drawdown funds: Satellite positions providing targeted access to specific managers, strategies, or vintages.

Evergreen funds: Core allocation, Offering the potential for steady exposure, reinvestment of distributions, and liquidity flexibility

For illustrative purposes only. Portfolio construction decisions, including the role of evergreen or drawdown strategies, should be based on each investor’s individual circumstances and objectives.

Together, they can help reduce reinvestment risk, smooth capital deployment, and balance private markets exposure across portfolios.

Choosing the right structure.

Needless to say, there are many alternative approaches to alternative investing. Even so, both evergreen and drawdown funds can play a valuable role. The right fit ultimately depends on your client’s goals, liquidity preferences, investment experience, and time horizon.

For investors earlier in their alternatives journey, the evergreen structure is a more accessible entry point. Features like lower minimums, immediate capital deployment, and periodic liquidity can provide added flexibility, potentially making it easier to build exposure over time.

For more seasoned investors, evergreen funds can complement traditional drawdown strategies, helping preserve allocations, smooth cash flows, and enhance diversification.

Your go-to for an owl’s-eye view on what matters most to us in Private Wealth.

Endnotes

Important information

Unless otherwise noted the Report Date referenced herein is as of September 2025.

Past performance is not a guarantee of future results.

Assets Under Management (“AUM”) refers to the assets that we manage, and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Credit and Real Assets products; and (v) par value of collateral for collateralized loan obligations (“CLOs”) and other securitizations.

The webpage presented is proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, funds sponsored by Blue Owl, including the Blue Owl Credit, GP Strategic Capital Funds and the Real Assets Funds (collectively the “Blue Owl Funds”) as well as investment held by the Blue Owl Funds.

An investment in the Fund or other investment vehicle entails a high degree of risk. Prospective investors should consider all of the risk factors set forth in the "Certain Risk Factors and Actual and Potential Conflicts of Interest" of the PPM or Prospectus, each of which could have an adverse effect on the Fund or other investment vehicle and on the value of Interests.

An investment in the Fund or other investment vehicle is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity associated with an investment in the Fund or other investment vehicle. Investors in the Fund or other investment vehicle must be prepared to bear such risks for an indefinite period of time. There will be restrictions on transferring interests in the Fund or other investment vehicle, and the investment performance of the Fund or other investment vehicle may be volatile. Investors must be prepared to hold their interests in the Fund or other investment vehicle until its dissolution and should have the financial ability and willingness to accept the risk characteristics of the Fund's or other investment vehicle’s investments.

There can be no assurances or guarantees that the Fund's or other investment vehicles investment objectives will be realized that the Fund's or other investment vehicle investment strategy will prove successful or that investors will not lose all or a portion of their investment in the Fund.

Furthermore, investors should not construe the performance of any predecessor funds or other investment vehicle as providing any assurances or predictive value regarding future performance of the Fund.

The views expressed and, except as otherwise indicated, the information provided are as of the report date and are subject to change, update, revision, verification, and amendment, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this webpage may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties (including those discussed below) that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl’s or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this webpage.

This webpage contains information from third party sources which Blue Owl has not verified. No representation or warranty, express or implied, is given by or on behalf of the Blue Owl Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this webpage and no liability whatsoever (in negligence or otherwise) is accepted by the Blue Owl Entities for any loss howsoever arising, directly or indirectly, from any use of this webpage or its contents, or otherwise arising in connection therewith.

All investments are subject to risk, including the loss of the principal amount invested. These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment advisor and the dealer manager, potential illiquidity, and liquidation at more or less than the original amount invested. Diversification will not guarantee profitability or protection against loss. Performance may be volatile, and the NAV may fluctuate.

This webpage is for informational purposes only and is not an offer or a solicitation to sell or subscribe for any fund or other investment vehicle and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, of any fund or investment vehicle managed by Blue Owl, or of any other issuer of securities. Only a definitive offering document (i.e.: Prospectus or Private Placement Memorandum or other offering material) can make such an offer. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus, Private Placement Memorandum or other offering material is truthful or complete. Any representation to the contrary is a criminal offense. Within the United States and Canada, securities are offered through Blue Owl Securities LLC, member of FINRA/SIPC, as Dealer Manager.