Please enter your business email to access this page.

Utilizing innovations in alternative investments to seek tax efficiency.

A young family with solid income but on a tight budget, trying to get ahead but at the same time faced with a lot of current expenses—has a lot in common with the university endowment trying to generate returns to meet complex operating budgets.

An older client who might have postponed prudent savings decisions and is now in catchup-mode—looks a lot like an underfunded pension in terms of the need to reach for yield.

A client who is ahead of the curve in terms of planning for the future, shares a lot in common with a large sovereign fund with little immediate-term liquidity pressure.

A young family with solid income but on a tight budget, trying to get ahead but at the same time faced with a lot of current expenses—has a lot in common with the university endowment trying to generate returns to meet complex operating budgets.

An older client who might have postponed prudent savings decisions and is now in catchup-mode—looks a lot like an underfunded pension in terms of the need to reach for yield.

A client who is ahead of the curve in terms of planning for the future, shares a lot in common with a large sovereign fund with little immediate-term liquidity pressure.

Each of these types of institutional investors uses the alternative investment opportunity set to augment the standard investment portfolio to better meet their needs. Your clients can too.

In this article we want to discuss a critical way in which your clients differ from large institutional investors: taxes. While institutions engage in careful planning to ensure they maintain their tax exemption, personal tax missteps can be especially costly for your clients, regardless of which of the buckets they fall into above.

Many advisors are familiar with Roth conversions, municipal bond investments, and other common methods for shielding income for clients in high tax brackets. Municipal bonds, in particular, have long been an attractive addition to the debt mix of a traditional 60/40 portfolio. But in today’s market, the alternative asset sector offers a number of products and strategies that broaden the set of tools available to high-net-worth clients. These include equity exchanges for concentrated stock positions, insurance-dedicated solutions, REIT investments, and IRC Section 1031 exchange transactions. It is important to note that the suitability of these strategies will depend on what is appropriate for each individual investor. Clients should consult their tax advisors to understand the potential tax implications and to determine the best approach for their specific financial situation.

Note: Guidance in this article is based on the tax landscape as of the report date.

Real Estate Investment Trusts (REITs) may offer several tax advantages compared to traditional yield-bearing investments. Just as mortgage payments a bank receives from homeowners consist of both interest and principal amortization, REIT distributions are typically a mix of return of capital (ROC), capital gains, and ordinary income, though the composition can vary. The return of capital portion is generally tax-deferred until the REIT is sold, which can provide a tax benefit. Meanwhile, the taxable portion of distributions may benefit from a 20% reduction in tax liability under current law, reducing the tax rate from 37% to 29.6%.1

The potential tax savings associated with a REIT investment can be significant. A simple numerical example helps illustrate this. Imagine a client can earn a 7% distribution on an investment grade bond. If the marginal tax rate on ordinary income is 37%, their after-tax take-home return is only 4.4%.

| Distribution2 | Taxable Basis | Tax Rate | Tax Payable | After Tax Distribution2 | Effective Tax Rate | |

|---|---|---|---|---|---|---|

| Corporate Bond | $7,000 | $7,000 | 37.00% | $2,590 | $4,410 (4.4%) | 37.0% |

| REIT with 0% ROC | $7,000 | $7,000 | 29.60% | $2,072 | $4,928 (4.9%) | 29.6% |

| REIT with 60% ROC | $7,000 | $2,800 | 29.60% | $829 | $6,171 (6.2%) |

11.8% |

| REIT with 90% ROC | $7,000 | $700 | 29.60% | $207 | $6,798 (6.8%) | 3.0% |

Note: The after-tax return illustration assumes a taxpayer in the highest federal marginal income tax bracket (currently 37%) with qualified REIT dividends eligible for the 20% QBI deduction. State and local taxes are not considered. Individual tax circumstances, income levels, and the applicability of the QBI deduction vary, and actual after-tax outcomes may differ materially. 29.60% tax rate in REIT scenarios includes the impact of 20% tax reduction on ordinary income. REITs and corporate bonds fundamentally differ, see disclosures.

Instead, consider the same 7% distribution in a REIT investment with 90% ROC – the effective tax rate on that distribution drops to 3%. A 7% REIT distribution could generate a 6.8% after-tax distribution, compared to the 4.4% distribution the investment grade bond investor faced.

These specific calculations rely on current tax rules, but the tax advantages of REIT investments can be robust. For example, suppose that only half the return was designated a return of capital, and suppose that the 20% tax break for REIT income was no longer available. Even in that world, the effective after-tax distribution of the REIT investment would be over 5.7%, compared to the 4.4% if the same 7% distribution were taxed purely as ordinary income. The larger amount of the investment return that is treated as return of capital, the lower the tax burden on the REIT investor. However, it is important to note that these benefits can vary based on individual circumstances and changes in tax legislation. The return of capital designation can create a structural advantage for REIT investments.

Another way to defer the realization of tax liability for your Qualified Purchaser clients is through the use of specialized insurance products. Strategies like private placement life insurance (PPLI) and variable annuities (PPVA) can provide tax-deferred growth on investments during one’s lifetime while offering prospective wealth & estate planning benefits for passing wealth between generations.

PPLI combines the cash value investment components of the PPVA with an insured net amount at risk that can create a federally-income-tax free death benefit. As a Variable Universal Life Insurance contract wrapped around a broad set of investment options, including private equity, hedge funds, private credit, real estate, and other alternative assets, PPLI can provide baseline benefits covering financial security and outsized solutions as a Wealth & Estate-planning tool.

The illustration is based on a specific profile - age, location, gender, and funding method - to demonstrate how PPLI strategies can potentially work in a tax-advantaged context. These assumptions were selected because they reflect a common client planning case. However, actual outcomes will vary depending on individual circumstances, insurance underwriting, investment performance and legal structures. Assumptions are for modeling purposes only and alternative assumptions may result in significant or complete loss of capital. There can be no assurance that any strategy will achieve comparable results or that any strategy will be able to or will ultimately elect to implement the assumptive investment strategy and approach described in the model.

PPLI retains the same deferral treatment on invested assets during the lifetime of the insured, with further benefits provided via policy ownership and structuring to potentially allow access to the cash balance growth via withdrawals of original basis or policy loans akin to the experience in a more traditional permanent life insurance product.

In effect, PPLI aids in optimizing an alternative asset balance sheet, turning tax-inefficient investments into more tax-efficient ones. At the same time, it helps clients potentially mitigate the risk of rising tax rates, which, depending on jurisdiction, can push combined ordinary income and capital gains taxes above 50%.

PPVA can serve as a cash-value insurance solution for long-term deferral, retirement and philanthropic goals; as an individual invests US dollar premium into a bespoke deferred variable annuity product. Upon receipt, the policy directs premium investments via the Insurance Carrier separate account into institutional investment solutions across both Public & Private Markets. By directing these investments within the insurance carrier separate account, the policy owner is provided deferral on any realization of ordinary income or long-term capital gains so long as policy investments remain within the Insurance product.

The illustration is based on a specific profile - age, location, gender, and funding method - to demonstrate how PPVA strategies can potentially work in a tax-advantaged context. These assumptions were selected because they reflect a common client planning case. However, actual outcomes will vary depending on individual circumstances, insurance underwriting, investment performance and legal structures. Assumptions are for modeling purposes only and alternative assumptions may result in significant or complete loss of capital. There can be no assurance that any strategy will achieve comparable results or that any strategy will be able to or will ultimately elect to implement the assumptive investment strategy and approach described in the model.

PPVA allows for potentially tax efficient distributions to the beneficial owner, fulfilling lower progressive income tax brackets in retirement. Additionally, PPVA can allow for a more efficient method to distribute alternative assets after death, via solutions such as stretching distributions to taxable beneficiaries and/or creating outsized philanthropic legacy gifts to Tax-Exempts; all without relinquishing control during an original policy owner’s lifetime.

By incorporating insurance dedicated solutions such as PPVA & PPLI into their financial strategy, clients can gain the dual benefit of institutionalgrade investment access and long-term tax efficiency—a combination that can enhance their overarching portfolio over time.

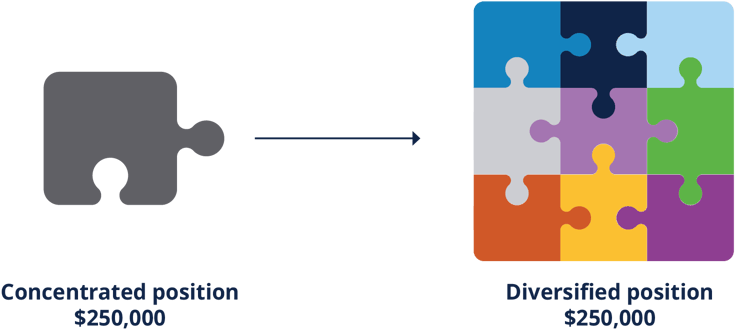

Your clients, particularly those that work for medium and large corporations, may develop concentrated equity positions in their portfolios over time, often due to equity compensation. Employee stock options, restricted stock units, or other company equity can provide growth opportunities but also increase the likelihood of an overly concentrated portfolio. These individuals likely need diversification but may face serious tax issues if they are to sell this stock. This burden is made all the more extreme by the fact that for many clients, these stocks will likely have a low cost-basis in their portfolio.

Figure 4

One potential solution to this problem may be an exchange fund. With an exchange fund, a client donates their shares to the fund and receives a portion of the fund ownership in return. They achieve diversification because now instead of holding a heavily concentrated ownership position in a single stock, they own shares of a diversified portfolio of stocks, and your clients defer capital gains tax because the transaction is structured as an exchange, rather than a sale and purchase. Exchange funds have a mandatory 7-year lockup period and are required by law to hold a certain fraction of assets in illiquid securities, so exchange funds are not right for everyone—they do not solve problems for a client with immediate liquidity needs. Nevertheless, they can be a useful tool for providing a client with increased diversification without triggering tax liability.

Many of your clients are not just invested in public and private capital markets, they own specific pieces of real estate, like business properties, rental homes, land and other “real properties”. Selling a property of this nature can generate a significant tax burden if it is not managed correctly. Fortunately, an IRC Section 1031 exchange (a “1031 exchange”) provides a way to potentially defer the tax burden from real estate sales.

In a 1031 exchange, a person selling a qualifying real estate investment can reinvest some or all of the proceeds in qualifying “like kind” replacement property, potentially deferring tax liability on the return. In principle, this is somewhat similar to the logic that applies when a person sells their primary home and buys another home; some or all of the profits they made on the sale of their primary home may be protected from tax liability because they are rolled over into the new home purchase. A 1031 exchange can achieve a similar outcome from a tax deferral standpoint. Taxpayers can acquire replacement real estate investments directly or potentially acquire interests in carefully structured tax-advantaged investment vehicles to complete their own 1031 exchange.

A simple numerical example illustrates the power of a 1031 exchange. Consider an individual who sold a vacation home for $1m. They bought this home for $500,000 and have taken $300,000 of corresponding depreciation deductions by the time of sale. Because the adjusted tax basis of the house is $200,000, the individual now owes tax on their $800,000 gain. If subject to federal income tax at 20%, this can take up to $160,000 away to pay applicable taxes. However, the individual may also owe state, local, and other taxes (such as the Net Investment Income Tax), depending on their individual circumstances and jurisdiction. These additional taxes could amount to another $160,000 or more. The after-tax proceeds of the sale could likely amount to $680,000 if there were no tax deferral, depending on the tax jurisdiction.

Now suppose that before the sale of the property, the individual had arranged with a “qualified intermediary” -- an independent facilitator of 1031 exchanges allowed by applicable tax rules, typically associated with a title company, a real estate attorney, or in some cases a bank -- to enter into a 1031 exchange rather than selling the property directly. Instead of the individual receiving the proceeds of the sale, the proceeds go into escrow with the qualified intermediary and are then transferred into the purchase of another qualified real estate investment. If done properly, this can defer tax liability on the sale of the property.

Engaging in a 1031 exchange takes advanced planning and careful compliance with all applicable tax rules. Generally, if your client takes receipt of the proceeds of the sale (either directly or indirectly, e.g., through an agent), it is too late to engage in a 1031 exchange. Other rules, including the impact of leverage and the number of replacement properties, may also affect the viability of a 1031 exchange. But helping your client plan in advance, including finding the right qualified intermediary, can be a powerful way to assist them when it comes time to make major adjustments to a personal estate such as this.

Of course, these are not the only ways in which you can help manage the tax burden of your clients. A new class of investment products has emerged that employ tax-efficient harvesting strategies to help lower the tax burden associated with the investment returns. After all, tax efficiency isn’t just about minimizing the tax burden in a particular year, it’s about strategically realizing gains and losses to maximize the growth of the corpus of investable capital over time.

In 1789, when Ben Franklin penned the famous lines "In this world, nothing is certain except death and taxes" to the French physicist Jean-Baptiste le Roy, he was contrasting death and taxes with the seeming impermanence of a newly written US Constitution. In the more than two hundred years that have since passed, we've done a great deal to push back against clutches of death, but the certainty of taxes remains as firm as ever. Every client you serve will have a unique tax situation that will depend on heirs, inheritance, wealth, the composition of their portfolio, and many other considerations. Helping them find thoughtful ways to shield their income and their capital gains from unnecessary tax burden can is one way to serve your clients in a truly differentiated way.

Endnotes

Your go-to for an owl’s-eye view on what matters most to us in Private Wealth.

Disclaimer

Private Placement Variable Annuity (PPVA) and Private Placement Life Insurance (PPLI) are unregistered securities products and are not subject to the same regulatory requirements as registered products. As such, PPVA and PPLI should only be presented to accredited investors or qualified purchasers as described by the Securities Act of 1933. If tax, legal, or actuarial advice is required, you should consult your accountant, attorney, or actuary.

Definitions - Figure 1

Distribution: Distribution is estimated based on market assumptions and is provided for illustrative purposes only.

After Tax Distribution: After tax distribution is reflective of the current tax year which does not take into account other taxes that may be owed on an investment in a REIT when the investor redeems his or her shares upon redemption, the investor may be subject to higher capital gains taxes as a result of a lower cost basis due to return of capital distributions.

Tax Equivalent Distribution: “Tax-equivalent distribution” is used to illustrate the after-tax income generated by the fund. This metric does not imply that the fund offers a yield or current yield. Instead, it provides an illustrative measure to help investors understand the tax impacts on the fund’s distributions. The tax-equivalent distribution is calculated using the formula: Tax- Equivalent Distribution = Distribution Rate / (1 - Tax Rate). This formula adjusts for tax impacts to ensure a comparable after-tax result. Distribution rates should not be implied to be a yield or current yield. Distribution payments are not guaranteed and may be modified at the fund’s discretion. The sources of the fund’s distributions may include income, return of capital, and other components. Tax calculation used in this table assumes a 37% federal tax rate.

Important information

Unless otherwise noted the Report Date referenced herein is as of April 30, 2025 .

Past performance is not a guarantee of future results.

Assets Under Management (“AUM”) refers to the assets that we manage and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Credit and Real Assets products; and (v) par value of collateral for collateralized loan obligations (“CLOs”) and other securitizations.

The material presented is proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, funds sponsored by Blue Owl, including the Blue Owl Credit, GP Strategic Capital Funds and the Real Assets Funds (collectively the “Blue Owl Funds”) as well as investment held by the Blue Owl Funds.

An investment in the Fund or other investment vehicle entails a high degree of risk. Prospective investors should consider all of the risk factors set forth in the “Certain Risk Factors and Actual and Potential Conflicts of Interest” of the PPM or Prospectus, each of which could have an adverse effect on the Fund or other investment vehicle and on the value of Interests.

An investment in the Fund or other investment vehicle is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity associated with an investment in the Fund or other investment vehicle. Investors in the Fund or other investment vehicle must be prepared to bear such risks for an indefinite period of time. There will be restrictions on transferring interests in the Fund or other investment vehicle, and the investment performance of the Fund or other investment vehicle may be volatile. Investors must be prepared to hold their interests in the Fund or other investment vehicle until its dissolution and should have the financial ability and willingness to accept the risk characteristics of the Fund’s or other investment vehicle’s investments.

There can be no assurances or guarantees that the Fund’s or other investment vehicles investment objectives will be realized that the Fund’s or other investment vehicle investment strategy will prove successful or that investors will not lose all or a portion of their investment in the Fund.

Furthermore, investors should not construe the performance of any predecessor funds or other investment vehicle as providing any assurances or predictive value regarding future performance of the Fund.

The views expressed and, except as otherwise indicated, the information provided are as of the report date and are subject to change, update, revision, verification, and amendment, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this material may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties (including those discussed below) that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl’s or its affiliates’ respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this document.

The information presented contains case studies and other discussions of selected investments made by Blue Owl Funds and other investment vehicles. These discussions provide descriptions and certain key aspects of such investments presented for informational purposes only and are intended to illustrate Blue Owl’s sourcing experience and the profile and types of investments and investment strategies which may be pursued by Blue Owl. The types and performance of these investments (i) are not representative of the types and performance of all investments or investment strategies that have been made or recommended by Blue Owl and (ii) are not necessarily indicative of the types and performance of investments that Blue Owl may seek to make, or be able to make, in the future. Any future investment vehicle that Blue Owl may sponsor or advise in the future, may pursue and consummate different types of investments in different concentrations, than those selected for illustrative purposes in this material. Further, references to investments included in illustrative case studies are presented to illustrate Blue Owl’s investment processes only and should not be construed as a recommendation of any particular investment. Past performance of any investment described in these illustrative case studies is not indicative of future results that may be obtained by any Blue Owl funds and other investment vehicles, and there can be no assurance that any such fund or other vehicle will achieve comparable results.

This material contains information from third party sources which Blue Owl has not verified. No representation or warranty, express or implied, is given by or on behalf of the Blue Owl Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this material and no liability whatsoever (in negligence or otherwise) is accepted by the Blue Owl Entities for any loss howsoever arising, directly or indirectly, from any use of this material or its contents, or otherwise arising in connection therewith.

All investments are subject to risk, including the loss of the principal amount invested. These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment advisor and the dealer manager, potential illiquidity, and liquidation at more or less than the original amount invested. Diversification will not guarantee profitability or protection against loss. Performance may be volatile, and the NAV may fluctuate.

Performance information

Where performance returns have been included in this material, Blue Owl has included herein important information relating to the calculation of these returns as well as other pertinent performance related definitions.

This material is for informational purposes only and is not an offer or a solicitation to sell or subscribe for any fund or other investment vehicle and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, of any fund or investment vehicle managed by Blue Owl, or of any other issuer of securities. Only a definitive offering document (i.e.: Prospectus or Private Placement Memorandum or other offering material) can make such an offer. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus, Private Placement Memorandum or other offering material is truthful or complete. Any representation to the contrary is a criminal offense. Securities are offered through Blue Owl Securities LLC, member of FINRA/SIPC, as Dealer Manager.