Institutions have long benefitted from access to private markets, as private investments have proven to enhance diversification, reduce volatility, and consistently outperform their public equivalents over time.

often as much as $10 million

due to infrequent performance reporting

resulting from long lock-up periods

The narrative is changing though. As demand from individual investors to allocate to private market strategies has increased, so too has the level of access. The evolution of fund structures, updates to regulation, and a proliferation of managers entering the private wealth space have collectively lowered these barriers for individual investors.

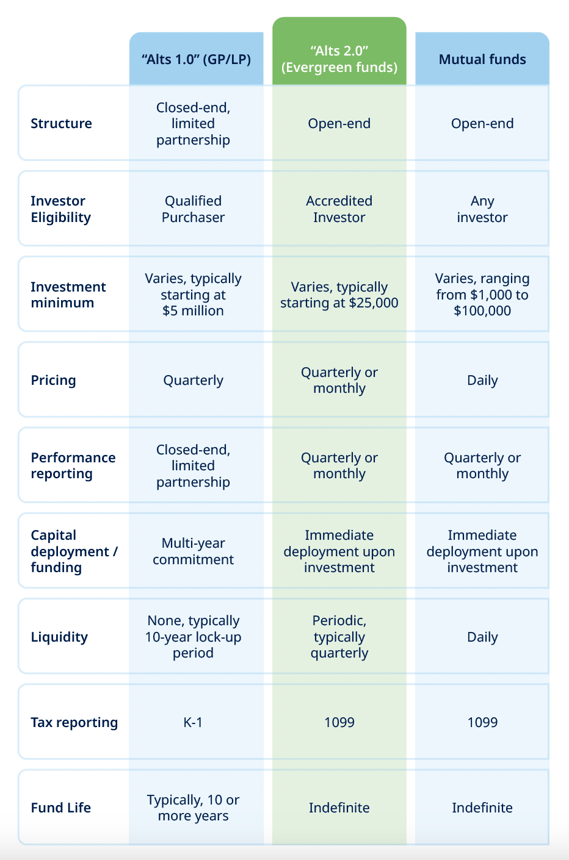

Private asset managers have made innovations to fund structures, developing and launching a far more investor-friendly vehicle for private markets — the evergreen fund. With lower minimums, greater transparency, and evolved liquidity features, evergreen funds (sometimes referred to as perpetual funds or open-end funds) create a new access point for individual investors.

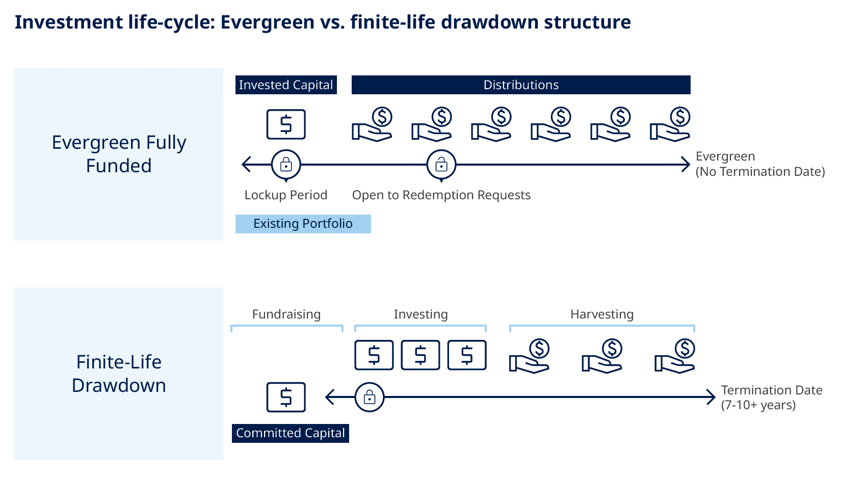

Unlike the closed-end structure of traditional private market funds, which typically locks up investor capital for a set number of years, evergreen funds don’t have fixed terms. Instead, this structure enables managers to continuously raise and deploy capital, allowing for ongoing investment and redemption cycles that can align better with the liquidity needs of individual investors.

Recent years have seen a great number of alternative asset managers create products designed for individual investors, creating even more access points. For investors evaluating allocation to the private markets, selecting the right manager is of critical importance. The role of the manager extends beyond investment diligence and selection. Unlike passive investments in public markets, private managers have direct influence over their investments – they actively oversee diverse portfolios of companies and assets, execute sophisticated investment strategies, navigate complex regulatory environments, and facilitate seamless investor experiences.

Institutions and private wealth advisors agree, the experience and track record of the fund manager are the most important things to consider while conducting due diligence on a private market investment. The dispersion between performance of top and bottom quartile managers is far greater in private markets vs. public markets – manager selection can lead to significant differences in performance. In turn, investors should evaluate an asset manager’s historical performance, investment philosophy, and operational capabilities to determine their ability to identify and capitalize on investment opportunities.

While a manager’s track record of performance is, of course, an extremely important piece of the puzzle, their track record of client service cannot be overlooked either. An asset manager is expected to guide investors through their journey, providing educational resources, assisting with onboarding experience, and offering continued service from operations and administration to transparency in performance reporting. Consequently, investors should also vet managers based on their commitment to broadening access and improving the investor experience.

Investing in private markets is not cumbersome as it once was. With the right manager, individuals can tap into the same sophisticated strategies that institutional investors have long leveraged in pursuit of greater returns, diversification, and stability.

The bridge has been built, it’s now up to individual investors to cross it.

Endnotes

Your go-to for an owl’s-eye view on what matters most to us in Private Wealth.

Important information

Unless otherwise indicated, the information referenced herein is as of September 2023.

Past performance is not a guide to future results.

This material contains proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, and may not be reproduced or distributed without express permission from Blue Owl.

The views expressed and, except as otherwise indicated, the information provided are as of the date herein and are subject to revision and verification, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this presentation may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl’s or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this document.

All investments are subject to risk, including the loss of the principal amount invested.

This material is for educational and informational purposes only and is not an offer or a solicitation to sell or subscribe to any fund and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, or any fund or vehicle managed by Blue Owl, or of any other issuer of securities.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Blue Owl. It Is delivered on an “as is” basis without warranty or liability. All individual charts, graphs and other elements contained within the information are also copyrighted works and may be owned by a party other than Blue Owl. By accepting the Information, you agree to abide by all applicable copyright and other laws, as well as any additional copyright notices or restrictions contained in the information.