When constructing portfolios, investors seek predictable returns in pursuit of their financial goals.

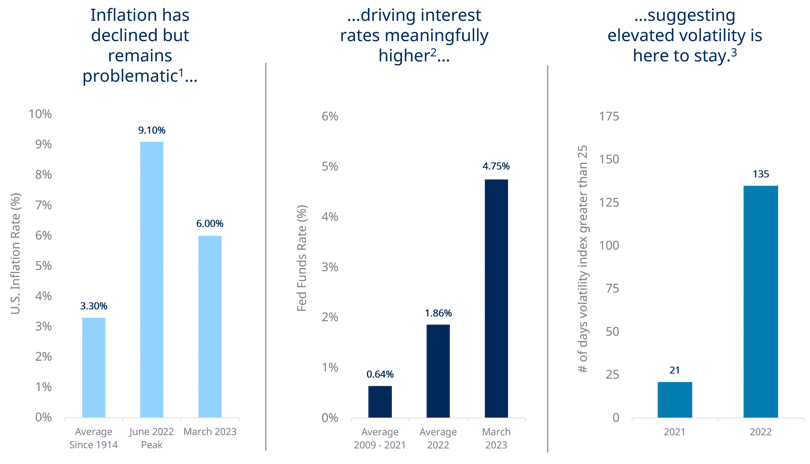

Today’s environment has proven to be a challenging place to accomplish that. While there are many factors at play contributing to the state of markets in recent months, there are two at the center of it all – inflation and rising interest rates. The pressure of these forces has not only created a highly volatile marketplace, but it has also seemingly exposed the vulnerability of the traditional banking model and the longstanding risks associated with asset-liability mismatching, elevating fears of more systemic issues in the banking system.

Against this backdrop of uncertainty, investors must continue to explore solutions outside of the public markets in pursuit of resilience. Historically, allocating to alternative strategies such as direct lending has helped to provide stability to portfolios during unstable times. Our goal in this piece is to help financial advisors and their clients understand the potential opportunities in spite of the market’s unrest.

As you may know, direct lending is a strategy within private credit in which non-banks make loans directly to private companies. These companies can be small/medium-sized businesses or large corporates and are backed (owned) by private equity firms. The certainty of capital that direct lenders can provide to borrowers enables them to command yield premiums, increased diligence, and better documentation than bank lenders. Direct lenders seek to hold their loans to maturity and pass interest payments through to investors in the form of periodic distributions. Scaled managers like Blue Owl fund these loans primarily with permanent capital raised from institutions and private wealth investors, which means their capital is not at risk of a “run on the bank.”

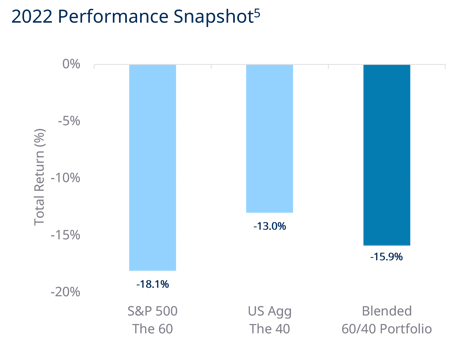

Public assets have stumbled considerably and the traditional 60/40 portfolio, once considered the standard of diversification, suffered its worst results since the stock market crash of 1937 as equities and bonds fell in tandem in 20224.

Of particular note is the 40% component: Due to the inverse relationship between fixed rate bond prices and interest rates, the aggressive rate hiking schedule employed by the Fed to curb inflation proved disastrous for fixed income portfolios. The Bloomberg U.S. Aggregate Bond index, designed to represent the full range of investment-grade corporate and treasury bonds traded in the U.S., suffered its worst calendar year since the inception of the index.

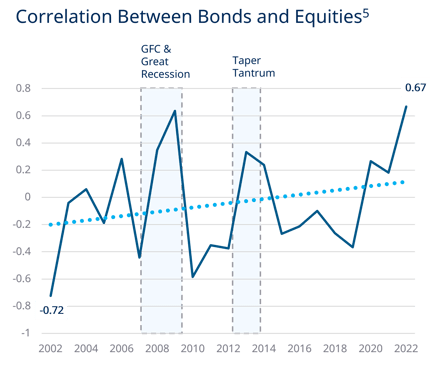

Fixed income is meant to play a stabilizing role in a portfolio, providing income and negatively correlated returns to public equities, but investors may need to recalibrate these expectations. Why? Over the last three years, we have seen the opposite and historical data suggests the high positive correlation between stocks and bonds will continue to stress the 60/40 portfolio this year. Layer on a growth slowdown, the threat of a recession and potential erosion in corporate fundamentals, the 60% is also likely to underwhelm as price appreciation becomes more elusive.

This breakdown of conventional diversification wisdom poses an important question – how can investors approach portfolio construction in the context of today’s market? The answer for an increasing number of investors has been the inclusion of alternative investments to introduce less-correlated, risk-mitigating assets into their portfolios. With more defensive features and a floating-rate structure, we believe an allocation to direct lending may offer compelling benefits in a portfolio. Here are three reasons why:

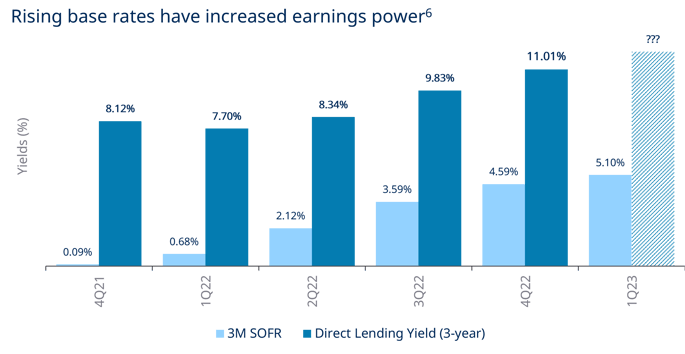

When interest rates increase, the values of fixed-rate debt investments are negatively impacted. Direct lending is insulated from rising rate pressures because the loans being made are floating rate, earning a credit spread (risk premium) plus a floating benchmark rate such as the Secured Overnight Financing Rate (SOFR). To put it simply, the all-in yields of these loans increase as interest rates do, which boosts income and has driven direct lending’s outperformance versus bonds during prior rate hiking regimes. Through a combination of improved terms and widening credit spreads in the last year, newly originated loans can feature yields of 12% or higher today.

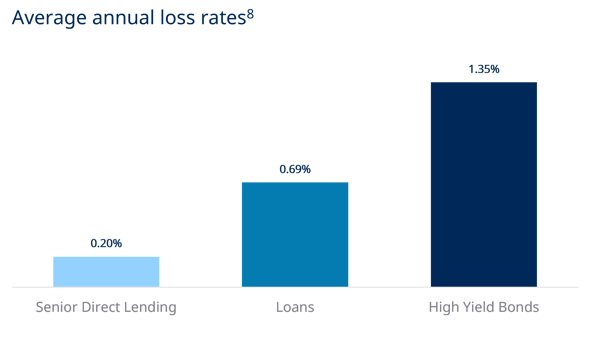

Periods of sustained inflation and higher rates can be followed by economic slowdowns with rising credit risks. Direct lending assets are typically secured by the borrower’s assets (cash, receivables, inventory, property, etc.) and can include a comprehensive set of protective covenants that require borrowers to maintain certain financial conditions and restrict them from taking on additional debt. Often, they are also traditionally the most senior assets in a company’s capital structure, giving them payment priority ahead of all other investors in the event of a default. While increased borrowing costs may push defaults higher in 2023, the median first lien recovery rate is 96% across all first-lien term loans over the last 20 years7.

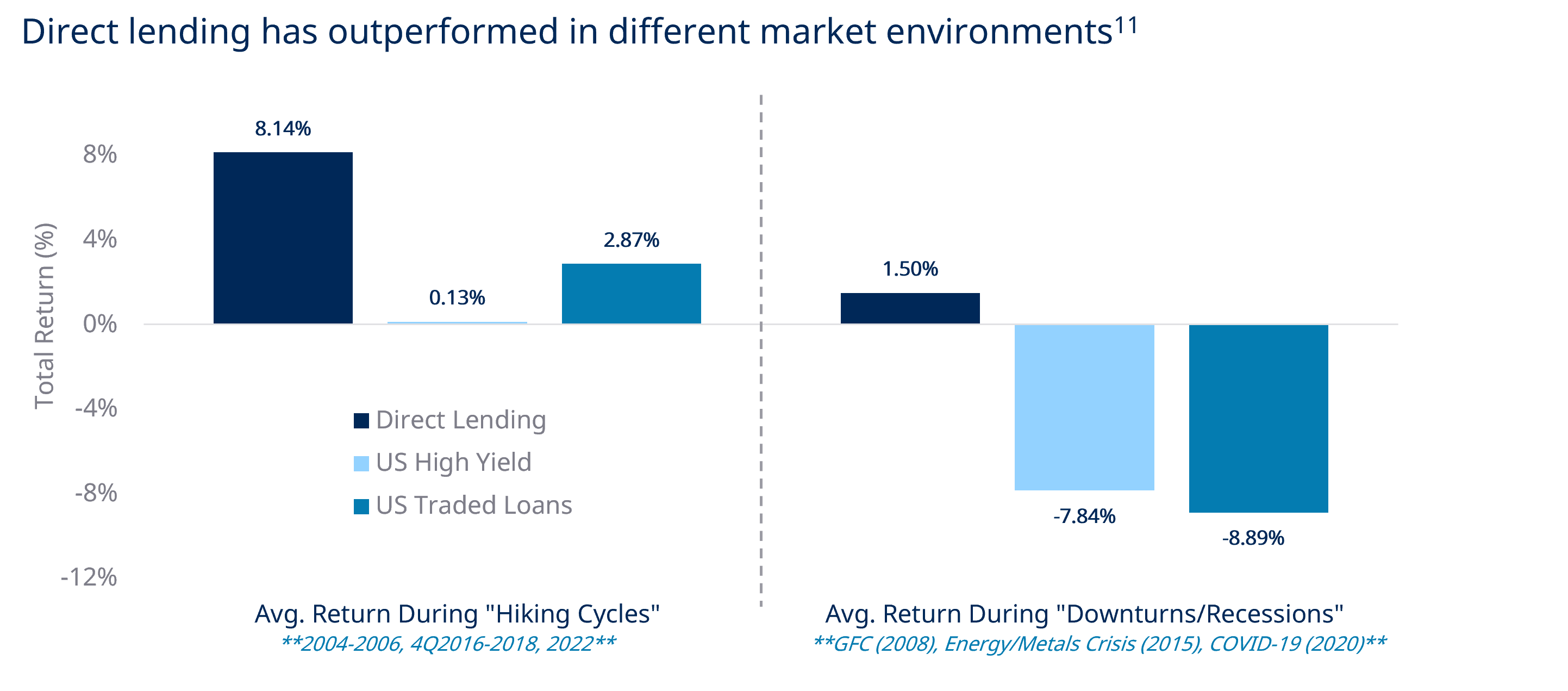

While direct lending maintains a defensive posture, this does not come at the expense of performance. The asset class has a track record of delivering consistent risk-adjusted returns across market cycles, particularly when compared to public leveraged finance markets and equities. This is because its returns are driven primarily by income and capturing that benefit doesn’t require market timing. Since 2005, this income advantage has averaged 389bps and 542bps versus the U.S. high yield and traded loan markets9. Over the same timeframe, the market has provided 100% of the returns of U.S. equities with only 25% of the volatility10. This combination of increased income and downside protection positions direct lending as a powerful diversification tool suited for all market environments, but especially unstable ones.

In our Direct Lending Outlook published in January 2023, we highlighted that the continued volatility in public markets has created meaningful opportunity in private credit. Blue Owl Co-Founder Craig Packer called today’s market one of the best investing environments for direct lenders, as banks remain unwilling or unable to commit to new financings. By providing certainty of capital to borrowers, direct lenders have been able to capture stronger protections and economics on new loans with banks largely watching from the sidelines. For investors, this translates to higher all-in yields and greater downside protection. Institutional investors have recognized the opportunity presented by this market, with a recent Preqin survey revealing that 83% of institutional private credit investors intend to make commitments to new funds in the first half of this year.12

As investors may consider options beyond the public markets in search of certainty for their portfolios, finding the right investment solution with an experienced partner is critical. Blue Owl’s market-leading direct lending platform brings scale, experience, and a strong track record to investors through innovative and easy to use fund structures designed to meet their needs. We believe a diversified portfolio must be able to provide consistent income, principal preservation, and hedge against volatility and inflation. Blue Owl’s direct lending strategies are purpose built to do just that – especially in today’s market environment.

Past performance is not a guarantee of future results. The views and opinions expressed herein are those of Blue Owl and are subject to change as markets and other conditions fluctuate. Blue Owl is under no obligation to update or keep current the information presented.

Endnotes

Important information

Unless otherwise noted the Report Date referenced herein is as of December 31, 2024.

Past performance is not a guarantee of future results.

Assets Under Management (“AUM”) refers to the assets that we manage and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Credit and Real Assets products; and (v) par value of collateral for collateralized loan obligations (“CLOs”) and other securitizations.

The webpage presented is proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, funds sponsored by Blue Owl, including the Blue Owl Credit, GP Strategic Capital Funds and the Real Assets Funds (collectively the “Blue Owl Funds”) as well as investment held by the Blue Owl Funds.

An investment in the Fund or other investment vehicle entails a high degree of risk. Prospective investors should consider all of the risk factors set forth in the "Certain Risk Factors and Actual and Potential Conflicts of Interest" of the PPM or Prospectus, each of which could have an adverse effect on the Fund or other investment vehicle and on the value of Interests.

An investment in the Fund or other investment vehicle is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity associated with an investment in the Fund or other investment vehicle. Investors in the Fund or other investment vehicle must be prepared to bear such risks for an indefinite period of time. There will be restrictions on transferring interests in the Fund or other investment vehicle, and the investment performance of the Fund or other investment vehicle may be volatile. Investors must be prepared to hold their interests in the Fund or other investment vehicle until its dissolution and should have the financial ability and willingness to accept the risk characteristics of the Fund's or other investment vehicle’s investments.

There can be no assurances or guarantees that the Fund's or other investment vehicles investment objectives will be realized that the Fund's or other investment vehicle investment strategy will prove successful or that investors will not lose all or a portion of their investment in the Fund.

Furthermore, investors should not construe the performance of any predecessor funds or other investment vehicle as providing any assurances or predictive value regarding future performance of the Fund.

The views expressed and, except as otherwise indicated, the information provided are as of the report date and are subject to change, update, revision, verification, and amendment, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this webpage may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties (including those discussed below) that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl’s or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this webpage.

This webpage contains information from third party sources which Blue Owl has not verified. No representation or warranty, express or implied, is given by or on behalf of the Blue Owl Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this webpage and no liability whatsoever (in negligence or otherwise) is accepted by the Blue Owl Entities for any loss howsoever arising, directly or indirectly, from any use of this webpage or its contents, or otherwise arising in connection therewith.

All investments are subject to risk, including the loss of the principal amount invested. These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment advisor and the dealer manager, potential illiquidity, and liquidation at more or less than the original amount invested. Diversification will not guarantee profitability or protection against loss. Performance may be volatile, and the NAV may fluctuate.

This webpage is for informational purposes only and is not an offer or a solicitation to sell or subscribe for any fund or other investment vehicle and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, of any fund or investment vehicle managed by Blue Owl, or of any other issuer of securities. Only a definitive offering document (i.e.: Prospectus or Private Placement Memorandum or other offering material) can make such an offer. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus, Private Placement Memorandum or other offering material is truthful or complete. Any representation to the contrary is a criminal offense. Securities are offered through Blue Owl Securities LLC, member of FINRA/SIPC, as Dealer Manager.